On Being Right

If you're smart enough you can be right, and articulately so, most of the time. This is one reason learned counsel, whether lawyer or not, is an archetype.

If you're a smarter-than-average person you may be asked to give a prediction about an event for which you're not expert. But if you're articulate, a lot of people will mistake your articulateness for expertise.

Consider the anecdote about Jeff Bezos addressing a group of Harvard Business School students about his then-nascent bookseller Amazon.

According to an anecdote originally related in Brad Stone's book The Everything Store: Jeff Bezos and the Age of Amazon, the MBA students told him to sell to Barnes & Noble, because competing against an entrenched competitor is a fool's errand.

You seem like a really nice guy, so don't take this the wrong way, but you really need to sell to Barnes & Noble and get out now.

Twenty-five years later we all see the folly in that argument.

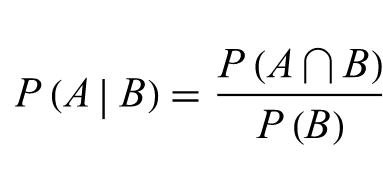

But here's the thing: most startups fail, and given that information, a smart Harvard MBA would have been correct to give Bezos the advice "sell". Given that most startups fail, the odds that any particular startup will succeed is very small. This is of course a conditional probability, and the more quantitative among the Harvard MBAs could give you a disquisition on them.

But these MBA students didn't. They just assumed, somewhat reasonably given the information they had, that Jeff Bezos was an average entrepreneur. And on average entrepreneurs fail!

Consider another rock solid argument from the experts. Most tall people fail to enter the NBA, and given that information, the smart person would be correct to advise a 6'8" 18-year-old to go to college and prepare to enter the conventional work force. But what if that 6'8" person was a young Lebron James?

Both Bezos and James are outliers, and it's possible that one could have looked at what made them unique, and inferred that normal outcomes were not likely for either one. One way to reconcile this: Smart people seem to be unusually good at predicting outcomes for people in the middle of the bell curve, but their intelligence often seems next to useless when considering the outcomes of people on the tails.

Predicting outcomes for the middle of the distribution is an exercise in pattern matching, and smart people are good at matching patterns. Predicting outcomes for the tails is an exercise in understanding what makes a particular individual unique, and that knowledge is often unavailable to the smart person asked to provide sagacious counsel.

There's a further angle here that warrants exploration. The MBAs' cognitive biases may have gotten the best of them. MBA students are, by and large, risk averse and non-entrepreneurial. And, given the information they had at hand--startup survival rates--they could present a very articulate case as to why the prudent thing for Bezos to do was to sell his nascent enterprise to Barnes & Noble and ride off into the sunset.

Since admission to Harvard Business School is competititve, the students all knew that they were smart. Smart people, on average, get things correct. Therefore, why would they entertain the possibility that their mental model for this particular entrepreneur was wrong? Just go with the inviolate truth: on average an entrepreneur competing against an entrenched competitor will lose. The logic is unassailable, and the entrepreneur should sell to his larger competitor.

These Harvard MBAs knew nothing of the ineffable qualities that made Jeff Bezos Jeff Bezos.

It is worth bearing in mind that back in the late '90s, many Harvard MBAs ended up going into either investment banking or management consulting, both of which businesses depend, almost entirely, on the wise counsel archetype being accurate and reliable.

Fortunately, as we now know, Bezos did not heed their advice and sell to Barnes & Noble.