On bitcoin, value, and use

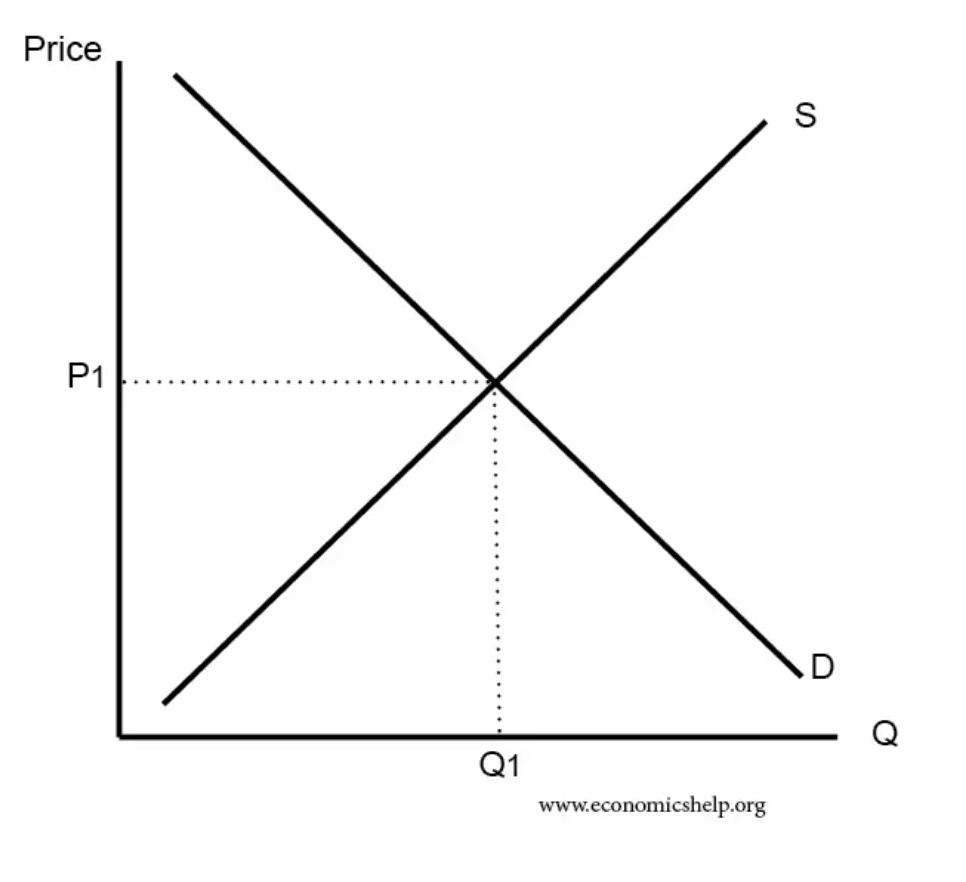

Noah Smith has a long and free post on his Substack newsletter about bitcoin, and crypto more generally. The post will annoy the juvenile maximalists, of course, but he notes that scarcity by itself does not create value. This is true: value is the intersection of demand and supply.

Noah argues, in part, that because bitcoin has demonstrated no real use case yet, its value is not supported by actual use. (It hasn't replaced fiat anywhere, even in El Salvador.)

I don't entirely agree with that claim, because bitcoin is used by speculators as a trading vehicle. People trade bitcoin, and various derivatives of it, such as volatility, forwards and futures, etc. That is certainly a use for bitcoin. Whether it is an economically productive use is another question. (Speculators will argue that they provide liquidity and price discovery to a market, which seems to be an economically productive endeavor.)

The argument from bitcoin maxis goes something like this: because the number of bitcoin is algorithmically determined, its supply is limited. Further, that supply can't be changed by anyone, unless that person controls at least 51% of the bitcoin network--a task so computationally expensive as to be considered impossible. And, further, because the supply has a hard limit and because that hard limit can't realistically be changed, the price of bitcoin has nowhere to go but up.

But I do think that crypto people miss something when they claim that scarcity by itself creates value. Gold has a mythos because it is scarce. It has value because people have a use for it. One use case for gold is as a hedge against the depredations of issuers of fiat currency.

Noah argues that concern about fiat inflation is overwrought and improper--and I agree! But his argument, and my agreeing with it, matters not a whit for those who disagree. And for those people the use case for bitcoin (or gold) is perceived protection from inflation.

But a use case does not depend on it being grounded in valid assumptions. And given the drop in bitcoin in the midst of high inflation, the use case of it as protection against fiat debasement doesn't make much sense.

And yet--in spite of its use case being incoherently applied by fervent bitcoin supporters--that use case still exists! That's not something that Noah or I can change. People want their bitcoin because they believe it will protect them against fiat debasement.

This is where a lot of economic theory falls apart. Bitcoin's value is largely mimetic--it is Girardian. People buy it and hold it because their friends buy and hold it, and communal affiliation is an extraordinarily powerful force. Bitcoin maximalists are almost religious in their fervor.

You can, by the way, see the same mimetic force in Tesla stock. A lot of people are convinced that Tesla is a fraud, and have sold its stock short. But its true believers act as a floor to its price. As long as they remain true believers and hold the stock, its room to fall is constrained.